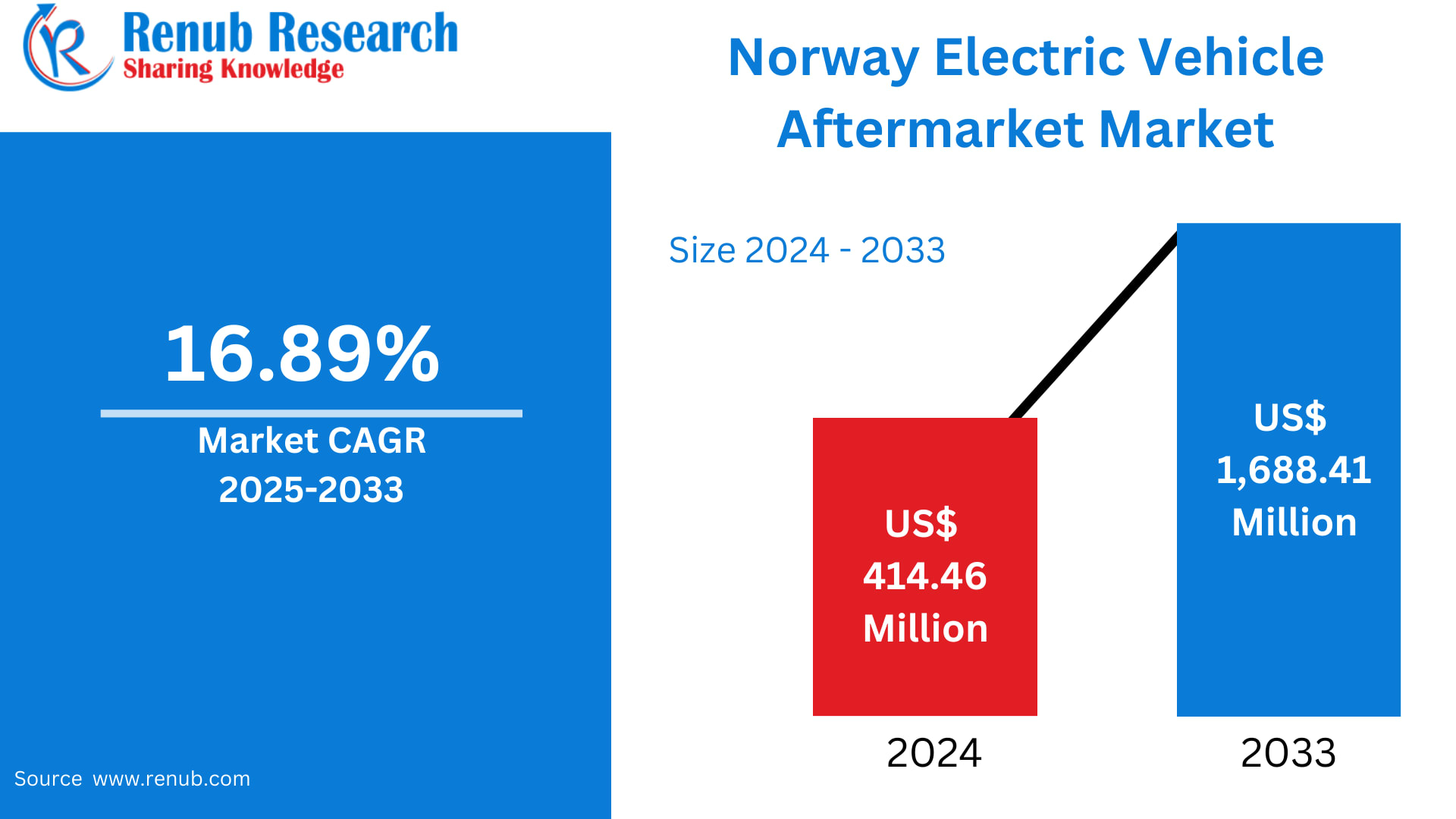

The Norway Electric Vehicle Aftermarket Market is on a rapid upward trajectory, projected to reach US$ 1,688.41 million by 2033, rising sharply from US$ 414.46 million in 2024. According to Renub Research, the market will record an impressive CAGR of 16.89% from 2025 to 2033, fueled by the country’s unparalleled EV adoption, robust sustainability goals, increasing demand for battery upgrades, expansion of charging networks, and a rising volume of used EVs entering the marketplace.

As the world’s most advanced EV ecosystem, Norway has become the benchmark for how market maturity, policy support, and consumer preference can transform not just vehicle adoption but the entire value chain surrounding it—including the rapidly growing EV aftermarket.

Understanding the Norway EV Aftermarket

The electric vehicle aftermarket comprises products, services, and solutions associated with a vehicle after it is purchased. Unlike conventional automobiles, EVs rely heavily on digital systems, high-capacity batteries, and advanced electronics. This creates evolving aftermarket needs centered around:

Battery repairs, refurbishments, upgrades, and replacements

Software updates and diagnostics

Tires, brakes, and body parts

Charging equipment and smart-charging solutions

Second-life battery applications

Energy management tools and accessories

As Norway’s EV fleet continues aging—and ballooning—the aftermarket has become a critical pillar of the nation’s mobility ecosystem.

Why the Norway EV Aftermarket Is Growing So Rapidly

1. Norway’s High EV Adoption Rate

Norway is the undisputed global leader in electric mobility. In recent years, EVs have accounted for the majority of new car sales, thanks to generous incentives such as:

Exemption from VAT

Free or reduced road tolls

Lower registration taxes

Preferential access to bus lanes

Extensive charging benefits

This has led to a massive and aging EV fleet requiring:

Routine maintenance

Battery replacements

Diagnostic services

Software optimizations

Spare parts for electronics and high-usage components

As more EVs shift into the used-car market, the demand for affordable aftermarket solutions is accelerating.

Norway’s continued emphasis on zero-emission mobility ensures aftermarket demand will remain strong through 2033.

2. Expanding Charging Infrastructure fuels aftermarket services

Norway boasts Europe’s most mature charging infrastructure—with both fast-charging corridors and densely packed urban charging points. This has several aftermarket implications:

Higher EV usage leads to increased wear on batteries, tires, and brakes

Smart charging solutions—such as V2G (Vehicle-to-Grid) and home energy management—create demand for installation and maintenance services

More charging hardware translates into ongoing replacement, repair, and upgrade requirements

Norway’s commitment to universal charging accessibility strengthens the entire aftermarket ecosystem, from charging equipment sales to servicing and upgrades.

3. Strong Sustainability Goals Driving Market Expansion

Norway aims to phase out all internal combustion engine (ICE) vehicle sales by 2025, a target unmatched globally.

This aggressive push toward climate neutrality is amplifying aftermarket demand across multiple categories:

Refurbished battery packs

Recycled auto parts

Second-life battery energy storage solutions

Green repair practices and eco-friendly workshops

Norwegian consumers prefer sustainable solutions, creating a significant pull for greener aftermarket services. For companies offering circular-economy products, Norway is an ideal testing ground.

Key Challenges Hindering Market Growth

Despite fast growth, Norway’s EV aftermarket faces constraints that industry stakeholders must address.

1. High Dependence on Imports

Norway has minimal domestic automotive manufacturing. As a result:

Most EV spare parts—especially batteries, semiconductors, and electronic components—must be imported.

Supply chain fluctuations, geopolitical tensions, and global shortages can trigger high costs and long delivery periods.

Exchange-rate volatility impacts pricing for service providers and consumers.

As EV adoption surges, import reliance may restrict affordability and availability, particularly for critical components such as high-voltage battery modules.

2. High Investment Requirements

Setting up advanced aftermarket infrastructure requires substantial capital, especially for:

Battery diagnostics and refurbishing equipment

High-voltage safety training for technicians

Specialized workshops

Advanced recycling and disposal facilities

Battery recycling remains a major challenge. End-of-life lithium-ion batteries are rising sharply, but recycling facilities are limited and costly. Strict EU and Norwegian regulations require environmentally safe handling, adding to compliance pressure.

Without a more robust recycling and refurbishing ecosystem, Norway may struggle to manage used batteries sustainably—potentially pushing up service and replacement costs.

Regional Market Insights

Norway’s EV aftermarket is geographically diverse, influenced by region-specific EV adoption patterns, charging infrastructure, climate, and commuting behavior.

Oslo Electric Vehicle Aftermarket

As the capital and Norway’s most densely populated city, Oslo is the heart of EV adoption and aftermarket services.

Key Drivers in Oslo

Highest EV penetration in the country

Dense urban charging network

Strong sustainability initiatives

Concentration of dealerships, workshops, and tech companies

The demand is highest for:

Battery replacements

Charging equipment upgrades

Routine maintenance

Software and diagnostic services

Challenges: High service costs, workshop congestion, and dependence on imported electronic components.

Viken Electric Vehicle Aftermarket

Viken is Norway’s most populous county and a commuter-heavy region.

Key Drivers in Viken

Large EV fleet fueled by daily commuting

Strong demand for battery servicing and replacement parts

Growth in used EV ownership requiring cost-effective repairs

Its proximity to Oslo gives Viken access to advanced suppliers, but rural areas still face service coverage gaps and a shortage of EV-trained technicians.

Vestland Electric Vehicle Aftermarket

Vestland combines urban hubs like Bergen with challenging mountainous terrain.

Key Drivers

Expanding public and private charging infrastructure

High EV ownership supported by local incentives

Harsh weather increasing wear on EV components

Strong sustainability push for battery recycling and green repairs

Challenges: High logistics costs and limited workshop availability in remote areas.

Rogaland Electric Vehicle Aftermarket

Home to Stavanger, Norway’s energy capital, Rogaland is an emerging EV aftermarket hotspot.

Key Drivers

Strong charging infrastructure

Innovation driven by the region’s energy and tech ecosystem

High commuting traffic increasing the need for maintenance

Rogaland is also a center for smart charging, energy storage integration, and EV–grid innovation.

Challenges: Limited local spare-parts inventory and shortage of specialized EV technicians.

Market Segmentation

By Type

Tires

Battery

Brake Parts

Filters

Body Parts

Lighting & Electronic Components

Wheels

Others

EVs consume tires faster due to higher torque, while batteries and electronic components dominate revenue share.

By Vehicle Form

Passenger Cars

Commercial Vehicles

Passenger cars account for the majority of demand due to Norway’s high private EV ownership, but commercial EVs—delivery vans, taxis, logistics vehicles—are rising rapidly.

By Distribution Channel

Authorized Service Centers (OEMs)

Premium Multi-Brand Service Centers

Digital Aggregators

Others

Digital aggregators are growing as tech-savvy Norwegian consumers prefer transparent pricing, online bookings, and mobile maintenance.

By States

Oslo

Viken

Vestland

Rogaland

Trøndelag

Vestfold og Telemark

Innlandet

Agder

Møre og Romsdal

Troms og Finnmark

Each region contributes uniquely, shaped by local EV density, charging availability, climate, and workforce skill levels.

Key Players in the Norway EV Aftermarket

Companies dominating the market include:

3M

ABB Ltd.

EVBox Group

ChargePoint Inc.

Webasto SE

Siemens AG

Bosch Automotive Service Solutions Inc.

Schneider Electric SE

These companies are expanding their footprint through innovations in charging, diagnostics, battery management, and energy solutions.

Final Thoughts

Norway’s Electric Vehicle Aftermarket Market is positioned for exceptional growth through 2033. With the EV revolution already mainstream in the country, aftermarket services—ranging from battery replacements to smart-charging installations—have become essential to keeping the mobility ecosystem functioning.

Challenges such as import dependence, high investment requirements, and limited recycling capacity still pose obstacles. But as technology evolves and the EV fleet expands, the aftermarket sector is expected to play a front-and-center role in Norway’s long-term climate, mobility, and sustainability goals.

Driven by innovation, consumer demand, and forward-thinking government policies, Norway stands as a model for how nations can build a resilient, scalable, and profitable electric vehicle aftermarket economy.