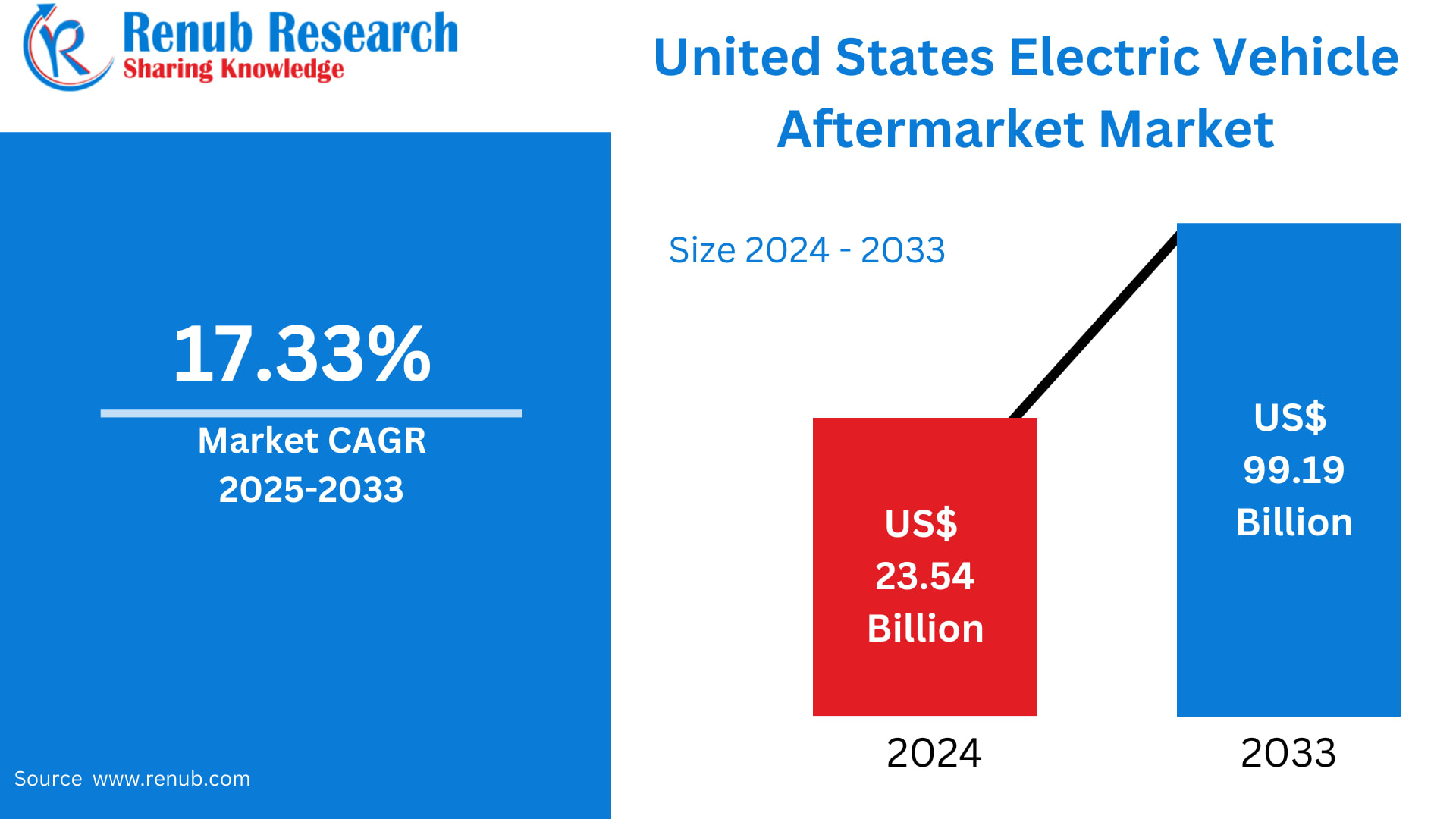

The United States Electric Vehicle Aftermarket Market is on the cusp of a monumental transformation. According to the latest insights from Renub Research, the market is projected to reach US$ 99.19 billion by 2033, growing at a striking CAGR of 17.33% from 2025 to 2033, up from US$ 23.54 billion in 2024. What was once considered a niche ecosystem is rapidly becoming one of the most dynamic, opportunity-rich components of the U.S. automotive industry.

This soaring growth is powered by the surge in EV ownership, the aging of early electric vehicle fleets, expanding charging infrastructure, and a rising need for batteries, electric drivetrains, EV-specific accessories, and advanced diagnostics. As both federal and state governments fortify their commitments to clean mobility, the EV aftermarket is emerging as a critical pillar in America’s transition to sustainability.

United States Electric Vehicle Aftermarket Industry Overview

The EV aftermarket encompasses the broad ecosystem of parts, components, technologies, and services that maintain and enhance electric vehicles once they are sold. Unlike the traditional aftermarket—which revolves around internal combustion engine (ICE) components such as oil filters, spark plugs, and exhaust systems—the EV aftermarket is defined by high-voltage batteries, electric motors, power electronics, charging systems, software updates, and digital diagnostics.

As EVs age and warranties expire, vehicle owners increasingly depend on independent repair networks, premium multi-brand service centers, digital aggregators, and specialized suppliers. The industry spans:

Battery replacements and refurbishing

Electric driveline components

Regenerative braking systems

Charging equipment installation and upgrades

EV-specific tires and accessories

Software/firmware updates

Energy management and telematics solutions

A growing share of early-generation EVs is now entering the used vehicle market, widening the customer base for cost-effective repairs and replacements. Meanwhile, suppliers such as Bosch, Continental, ZF, and Magna are expanding their EV component portfolios, while newcomers introduce innovative charging and diagnostic solutions. This shift is transforming what was once a specialized niche into a mainstream automotive powerhouse.

Growth Drivers for the United States Electric Vehicle Aftermarket Market

1. Expansion of Charging Infrastructure

One of the most influential factors driving aftermarket growth is the rapid expansion of EV charging infrastructure across the country. Supported heavily by federal funding under programs like NEVI, the United States surpassed 183,000 public charging ports by mid-2024—a milestone that signals a massive rise in demand for installation, servicing, software integration, and periodic hardware upgrades.

New players such as MSI, which launched its EV Life Series chargers in the U.S. in September 2025, are introducing consumer-centric solutions with features like:

Dual connector options (NACS and J1772)

App-based monitoring

Long IP-rated cables

Variable power outputs

Such innovations create ongoing maintenance and upgrade opportunities, strengthening the aftermarket’s long-term revenue base.

2. Rising EV Adoption Nationwide

As more Americans embrace electric mobility, the EV aftermarket is experiencing exponential expansion. Growing consumer demand and corporate fleet transitions are increasing the need for:

Battery replacements

EV-compatible tires

Charger maintenance

Software updates

Suspension and braking components

Many early EV models launched roughly a decade ago are now exiting their manufacturer warranties, allowing the aftermarket to play a dominant role. Independent service centers are investing in high-voltage tools and technician training, while tech-driven diagnostic players enter the arena with cloud-based, AI-powered servicing platforms.

The growing national EV fleet ensures long-term consistency in aftermarket demand, benefiting both established suppliers and innovative startups.

3. Technological Advancements Creating New Aftermarket Verticals

Emerging technologies are reshaping the aftermarket landscape. Advancements such as regenerative braking systems, over-the-air (OTA) software updates, improved battery chemistries, and high-efficiency drivetrains require specialized tools, components, and expertise.

A notable milestone came in 2024, when ZF Aftermarket launched 25 Electric Axle Repair Kits for North America—solutions that allow EV drivetrains to be repaired instead of replaced entirely. This lowers costs for owners while expanding aftermarket service opportunities.

OEM suppliers like Bosch, Siemens, Webasto, and ABB are also broadening their EV-focused offerings, from AC/DC chargers to thermal management systems. As software becomes an integral component of vehicle performance, the aftermarket is evolving to include digital tuning, telematics-based diagnostics, predictive maintenance, and firmware services.

Key Challenges in the U.S. Electric Vehicle Aftermarket Market

1. Battery Costs and Recycling Barriers

Lithium-ion batteries remain the single most expensive EV component. Replacement costs often run into the thousands, creating hesitation among used EV buyers. Compounding this is the limited availability of robust recycling infrastructure, which affects:

Material recovery (lithium, nickel, cobalt)

Supply chain stability

Repair affordability

Environmental sustainability

Without widespread battery refurbishing and recycling capabilities, aftermarket expansion is constrained, particularly as large numbers of EV batteries approach end-of-life over the next decade.

2. High Initial Investment for Repair Shops

For small and mid-sized independent workshops, entering the EV aftermarket requires significant upfront spending. This includes:

High-voltage safety gear

Dedicated battery lifts

Insulation tools

EV diagnostic software

Technician training and certification

While essential for safety and regulatory compliance, these costs deter widespread participation and limit consumer choices. If incentives and support programs for EV service readiness do not expand, the industry risks becoming concentrated among larger chains rather than fostering a diverse service ecosystem.

State-Level Market Breakdowns

California: The Largest U.S. EV Aftermarket Hub

California leads by a wide margin in EV penetration, charging infrastructure, and clean mobility policies. The state’s huge EV fleet—including a fast-growing used EV segment—drives demand for:

Battery replacements

Charging equipment

Software updates

High-voltage component repairs

California’s innovation ecosystem fosters partnerships between OEMs, startups, and service providers. This makes the state the most dynamic and influential EV aftermarket market in the nation.

Texas: A Rapidly Rising EV Aftermarket Leader

Texas is emerging as a major EV aftermarket hotspot, powered by:

Growing EV ownership

Large-scale grid and charging investments

Battery and component manufacturing sites

A robust logistics network

Independent service centers are expanding their EV offerings, particularly in urban hubs like Austin, Dallas, and Houston. The state’s large SUV and truck market creates strong demand for EV-compatible tires, brakes, and drivetrain repairs.

New York: Innovation and Urban Mobility Driving Growth

New York’s EV aftermarket is strengthened by the state’s aggressive clean energy goals and widespread urban EV adoption. Key drivers include:

Growing public EV fleet usage

Advanced manufacturing and research facilities

Expanding used EV market in NYC

Investments in charging solutions and grid modernization

Independent shops are steadily upgrading their EV capabilities, supported by strong policy incentives.

Florida: One of the Fastest-Growing Aftermarket Markets

With high vehicle ownership rates and strong EV adoption momentum, Florida is becoming a key aftermarket region. Demand is driven by:

Battery maintenance

Home and commercial charging equipment

EV fleet servicing in rental/tourism sectors

Customization and upgrade trends

Major ports in Miami, Tampa, and Jacksonville also support strong component imports and distribution.

Recent Developments in the U.S. EV Aftermarket

MSI made its U.S. debut in September 2025 with the EV Life Series chargers featuring both NACS and SAE J1772 connectors.

ZF Aftermarket introduced 25 Electric Axle Drive Repair Kits in August 2024, enabling independent shops to repair EV axles instead of replacing them.

Coulomb Solutions Inc. launched its Advanced Accessory Module (AAM) in May 2024—a compact unit integrating charging, high-voltage delivery, accessory electronics, and thermal management for EVs.

Market Segmentation

By Replacement Parts

Tire

Battery

Brake Parts

Filters

Body Parts

Lighting & Electronic Components

Wheels

Others

By Vehicle Type

Passenger Car

Commercial Vehicle

By Distribution Channel

Authorized Service Centers (OEMs)

Premium Multi-Brand Service Centers

Digital Aggregators

Others

By States (29 Viewpoints)

Includes: California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, and Rest of United States.

Key Players Covered

Each analyzed across: Company Overview, Key Persons, Recent Developments & Strategies, SWOT, and Sales Analysis

3M

ABB Ltd.

EVBox Group

ChargePoint Inc.

Webasto SE

Siemens AG

Bosch Automotive Service Solutions Inc.

Schneider Electric SE

Final Thoughts

The United States Electric Vehicle Aftermarket Market is entering a period of unprecedented acceleration. With EV adoption rising, fleets aging, and federal policies supporting clean transportation, the aftermarket is rapidly transitioning from a specialized niche to a mainstream automotive powerhouse.

Between 2025 and 2033, nearly every aspect of EV ownership—from charging and diagnostics to tires, batteries, and digital services—will undergo expansion. The result is a vibrant, innovation-driven market poised to surpass US$ 99 billion by 2033.

For OEMs, independent service providers, technology companies, and investors, the U.S. EV aftermarket represents not just a growth opportunity, but a pathway to shaping the future of transportation.